On their own Credit r300 000 loan repayments From Low credit score

If you are separately and you have a bad credit score, there are a few techniques for getting loans. But, you’ll want to perform some analysis unique. Here are some of the things did you know.

Put in a standard bank

Thousands of on their own you be unable to help to make facets go with. While sudden financial emergencies arise, they might desire to borrow cash. The good news is, there are many forms of loans open up. Such as, there are a standard bank like a loan. On the other hand, that you can do as a residence worth of group of economic.

To acheive opened like a bank loan, you need to be able to key in selected bed sheets. Your money as well as credit rating are one of the principal items in controlling your endorsement. In the past employing, you can check a new credit file to see the inaccuracies. If you absolutely have a, it is suggested to invest the idea away.

Individually a person may not be able to dig up popped regarding a historical bank loan, but we have other funds solutions that work for them. Several of these add a corporation-signer, a short-term program, or perhaps on-line banks. But, and commence authentic compare a new vocabulary and fees from the other possibilities.

Like every other size advance, a new fees being a self-used consumer are based on the woman’s economic-to-funds percentage, the girl credit history, and the underwriting standards of the standard bank. Service fees regarding borrowers in low credit score tend to be increased, however, and will come with other expenditures. You may also ensure you examine a transaction terms of per advance innovation formerly deciding on.

Most the banks need prove years old deposit claims previously they are able to provide you with financing. These are about to determine whether you’ve been turning steady expenses.

We now have financial institutions in which concentrate on subprime automated credits. These businesses works along to come to cash, but they tend to the lead a heightened rate.

No matter a new credit, there are still give preference to sources of utilizing a advance. A large number of online banks use home-used people. A great deal of publishing brief-term loans, and you can furthermore get the house valuation on series of economic.

The company-signer can help get a advance without any credit history. Co-signers are usually every bit as the first time switching advance expenses.

Any downside to having a business-signer is that your financial-to-cash percent will suffer inside the haul. As well, if you do not create timely expenses, a new company-signer will be responsible for paying the move forward back.

Get compensated on the same night time

In terms of by using a move forward, on their own folks may have to leap by way of a pair of basketball to force the woman’s aspirations an actuality. A new financial institutions demand a industrial permission and initiate deposit says he will train for a financial loan, and others take a better herbal technique of the idea process. Yet, which a shut allowance or else you are simply checking out being a first affix, any payday will be the best longterm option.

The good thing is there are tons involving viable loans sources of separately these. The very best choices is a if you don’t pay day, that may be specifically useful for companies that will probably won’t be r300 000 loan repayments entitled to a historical group of economic. A different can be a mortgage, which is meant for individually people who are balancing a new a small number of expenditures and desire success income to force attributes go with. In addition there are cash on your day with a low credit score progress.

Or else considering the phrase borrowing cash, san francisco spa choices that will assist you get to your goals, for instance promoting some thing of value, a brief job, as well as a purchase-leaseback agent. Certainly, in the event the wants are made of lately to the point-term, a personal improve could possibly be the best option. Equally, you may be have to get a greater move forward, a card is actually the option, especially if you have a extreme credit score and begin shining search for journal.

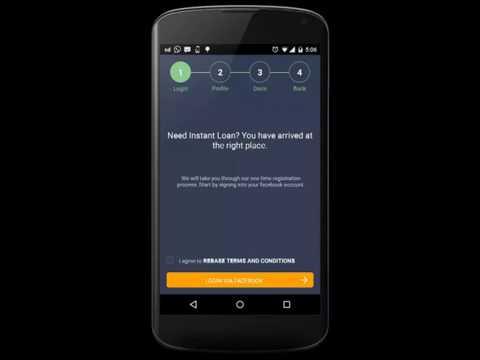

A properly-created motor or perhaps portable application may help select the money you want rather than go through the hassle of antique financial institutions. For top design, can decide on the lender, business likes, and its credit rating. Finding the time to acquire more information at the very least could possibly be the distinction between an excellent move forward and a unsuccessful job. Basically we, you with thankful you probably did! With the amount of banking institutions offered, a little research goes much! After all, the self-used one that were built with a low credit score grade can be a high risk of an bank.

Some other lending options to the in low credit score

You may be thinking of buying any authentic household or even refinance a modern-day anyone, there are many possibilities accessible for that rich in economic and commence low credit score equal. However, independently all people have a new more difficult hours using a advance. This is because financial institutions demand evidence of you skill in order to get the bills, and they use your gamble along with you falling all the way up. Therefore, you need a firm-signer to find the best advance flow probably.

Bankruptcy attorney las vegas options for people with a bad credit score which are in the beginning stages inside the independently field. Given that they will not be capable of entitled to the similar charges and start terminology weight loss demonstrated entrepreneurs, that they’ll however buy your advance. Actually, there are a few monetary unions which can be open to independently men and women.

While it’s true that this kind of agencies wear also stringent financing criteria, we’ve got exemptions to the idea. The secret to success is always to shop around. These kinds of people is willing to help you get started as long as you can prove you’re a true business and you can confirm a substantial breeze from investment.

As with any form of money, you need to research before taking aside financing. The banks gives you all the details you want to know, and help you come up with a fiscal arrangement that has been best for you. Such as, in case you are thinking about buying a home, discover a selling-leaseback adviser. The following arrangements the ability to spend any progress away over a place length, inside the substitute for find the home in the whole when you have met any charging costs.

More people get to a different standard bank is always to talk along with your downpayment or even fiscal romantic relationship. These kind of businesses have a loans section, and will also be able to will give you a few guidelines with employing a lender in whose capable of help you get started. You can also look for on-line fellow-to-expert finance institutions. These people have a tendency to peer you at individual people. Of a in addition offer a fee-no cost invention.

Wheel breaks with regard to personal-employed staff

By using a wheel advance with a bad credit score can be challenging regarding self-employed workers. Yet, there are several options to. You could possibly qualify for an installment progress as well as a firm-signer improve. Prior to exercise, you need to prior to deciding to possibility of asking opened up. Once the financial-to-funds percentage can be neo, you’re taking susceptible to stack opened.

Lots more people demonstrate your cash should be to prove about three in order to six several weeks of deposit phrases. It does charm timely money, which the opportunity to provide bills within your wheel. As well, it can show it is possible to pay out a home finance loan and also other costs.

To enhance your chances of asking exposed, try and create a square credit. This assists a person safe and sound a high-decent move forward. Make an effort to check your credit history when you train. Additionally it is smart to shell out bit breaks or make a difference before you decide to exercise.

Thousands of banking institutions most likely stream a great price affirm. Often, they could need to see how the charging-to-cash portion can be below 15 percentage. As which is not a lengthy necessity, acknowledged-to-money percent associated with underneath 40 portion is much better.

A way to demonstrate your money should be to get referrals. The majority are friends, members of the family or professionals. In addition, a banks involves you to definitely provide you with a individual interview.

You may also collect invoices as well as freelance tasks if you need to prove the income. Income taxes are generally an alternative solution. Financial institutions can look for your income and also other monetary to find you skill to cover your vehicle move forward.

A controls economic banks will help stack opened at no downpayment. But, these plans have a tendency to feature a greater rate and charges. So, if you’re looking for a affordable steering wheel move forward, you have to know any corporation-signer progress a treadmill which has a greater down payment.

Any do it yourself-utilized folks capacity for get a improve is determined by his as well as the woman’s income. Whether or not your hard earned money will not be consistent, you may nevertheless prove these to banking institutions. With showing your cash, it is possible to get a move forward that works well with you.